Table of Contents

Everything around us, in nature, in human society, in life is constantly evolve. Some 5 thousand years ago humanity invented money. Since then, it became a cornerstone of human civilization, state, society, and our way of life.

Money is a wager. But money changes. From stones to golden and silver coins to banknotes and then to credit/debit cards. Constantly evolving, always changing. Yet again, we came to another threshold – virtual payments, online wallets, and digital transactions all over.

New Ways Of Paying

We have covered online banking software previously but let’s focus our attention on something a little bit more specific, something kind of like SquareSpace, one of the leading fintech platforms in the world of the same caliber as PayPal, Skrill, and Payoneer. Apple Pay has also made its move and the same applies to Google Pay. Everyone is aiming at FinTech to make a dime on each digital transaction.

So, we will talk about the future of money. Money in your smartphone that you can send anytime anywhere practically for free. What’s the catch, you may ask? Well, if you manage to promote and market your solution globally, then the amount of your users will itself be an incredible asset. That’s one thing. You will have cash on hand the same as banks and it is up to you what to do with this cash while your user do not need it. That’s how banks work, right? What changed, though, is that a bank is not decentralized and equally distributed. Everyone has a bank in his hand at all times. Even one of the most low-quality messengers Viber added payment option to its app quite recently. If Viber can do it, everybody can do it, believe me.

How Difficult It Is

Well, I’m not going to lie, it is difficult. Among the variety of software products FinTech apps and Healthcare apps are the most complex to develop and tough to ship to market. First of all, your app should be up to standards and I mean national certified standards.

Here’s How Wikipedia defines Peer-to-Peer transactions:

Peer-to-peer transactions (also referred to as person-to-person transactions, P2P transactions, or P2P payments) are electronic money transfers, offering a convenient alternative to traditional payment methods.

People value their money the same they value their health and not everybody deserves to handle the responsibility of securing user’s money. Therefore, you have to prepare for all possible ups and downs. The most obvious danger, though, comes from the physical banks that have their own apps. These conservative powers will do everything in their power to sabotage your efforts. It was truly difficult to predict how Apple would resolve market batles with JP Morgan. Thus, they became partners and Apple Pay was born (physical credit card, I mean).

Physical anks wth their own apps are the toughest competitor. However, there are many examples like Squsre, Paypal, M-Pesa, Payoneer and Skrill to consider when debunking the monopoly of banks. Although, one should consider that some of these fintech platforms have more in common with banks and finance companies than software software products. Still, yet, underneath it is all is always software.

Start Small – Locally

To start locally at your regional level is the best advice you’d get. This is especially important in case with online banking and mobile banking P2P payment solutions, since they require to adhere to a lot of regulations.

What is the Price?

$80K for a complete P2P Payment System. $50K for MVP. These are average calculations but they are quite precise. These are the prices on the European market.

Use Third-Party API to Reduce Costs

You can use existing fintech solutions and integrate them on your digital platform. That is a good choice to opt for if you own online store, deal in money exchange or provide online wallet services. You can reduce costs, development time, and regulatory setbacks.

How to Monetize

Monetizing a P2P payment system is basically done with a comission on every transaction. It is usualy beteen 1-3% but it can sometimes go as higer as 10%. Therefore, to leverage the fintech software product one should have strength in number – many users. With a lot of active users thr aggregated fee percentage might be a sustainable business operation.

List of Popular Solutions

- M-Pesa (largest African payment system)

- Libra (not launched yet)

- Apple Pay

- Google Pay

- PayPal

- Venmo

- Payoneer

- Skrill

- Square

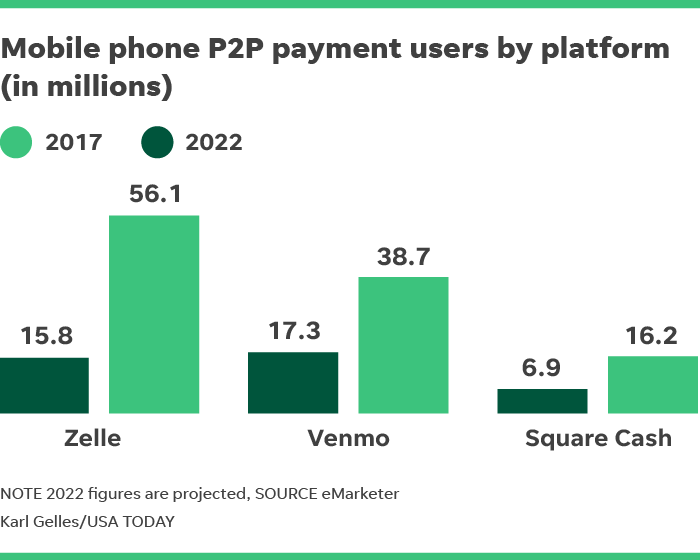

As you can see yourself, no monopoly here, just business as usual with healthy enough competition. Keep in mind, though, that most of the fintech business operations are internation. Even though you start locally, you might consider planning on gradual expansion to enlare your client base.

Conclusion

Well, developing a p2p payment app is a good idea, since this business is now on the rise. More people spend more money online globally and itnernationally. They do it via a dozen or two popular solutions distributed locally or widely. Consider to use third-party APIs ro save on costs. You should also make a preliminary research on all the scrupulous regulations on fintech service sector. Good luck!