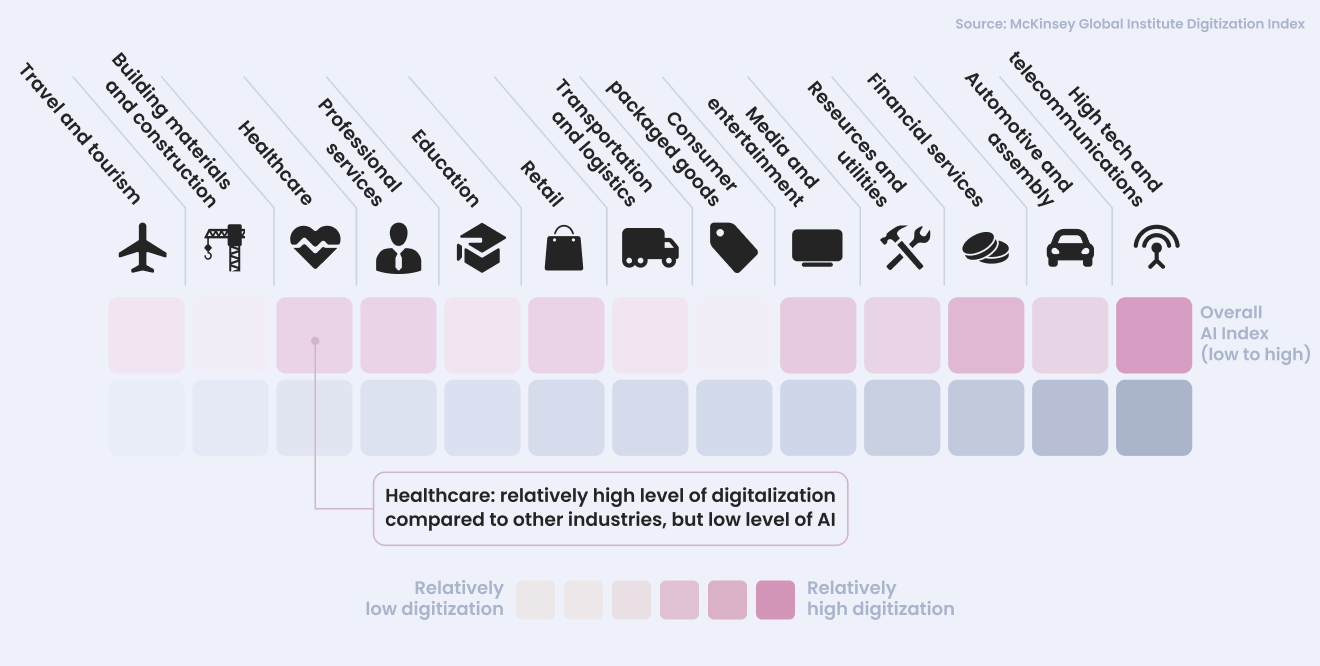

The Role of Digitalization in the Health Insurance Industry

The adoption of cutting-edge technologies allows health care organizations and insurance providers to take advantage of digital health solutions and reinvent the way how these institutions operate.

The main value brought by digital technologies is manifested through the next improvements:

- increased productivity of administrative staff and doctors;

- reduced percentage of errors;

- revenue growth;

- reduced administrative and medical expenses;

- higher customer satisfaction.

Digital health solutions open new opportunities for insurers, namely enabling advanced data generation and its future use for more precise, rational decision-making.

Nowadays, insurers have more tools to expand their data collection, and it will help not only to improve the internal business processes and eradicate outdated, inefficient approaches but also to acquire a deep understanding of the lifestyle and behavior patterns of their clients. Hence, health insurers get a chance to provide customized plans to protect themselves from excessive compensations.

At the same time, digital health technologies also upgrade medical procedures, e.g., powering up remote health monitoring for risk groups or introducing telemedicine. These tools help clients to address their health problems in a more rapid manner and generally maintain their well-being on a high level. In the end, it is a win-win situation for both the client and the insurer.

The bottom line is that the variety of digital solutions brings an enormous number of opportunities for health insurance companies. They can easily pivot their digital transformation strategy in any direction without stumbling onto almost any limitation.

The Main Components of Digitalization in the Health Insurance Sector

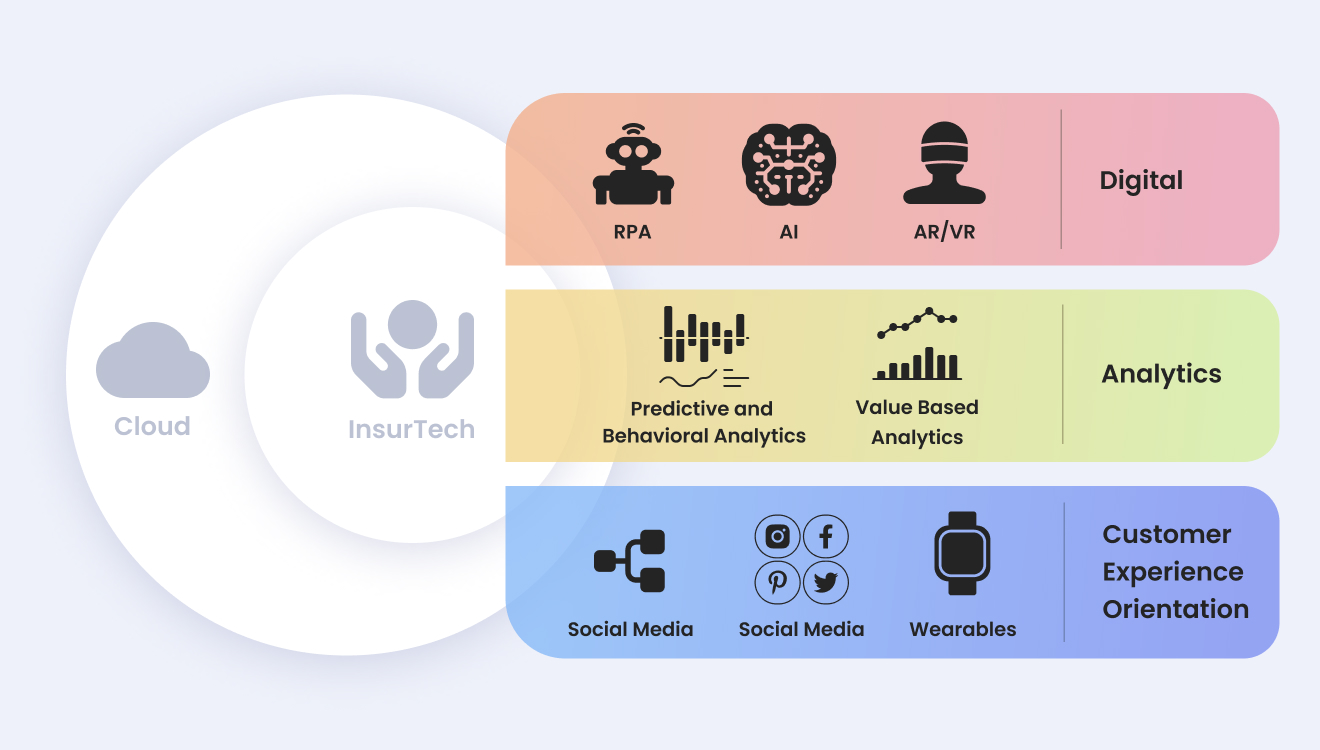

When launching digital transformation, healthcare businesses should divide this change into three branches: business model, operational processes, and customer experience. Each of them is vital and is able to drive business growth from short and long-term perspectives.

Business Model Digitalization

This implies a change in how your business function interacts, which consequently leads to changes in business activities. Here, you can expect the digitalization of your business processes, and the introduction of new processes born thanks to digital tools.

For the health insurance industry, it brings a new approach to the calculation of insurance premiums, better claim processing, fraud detection, the creation of new services, and, hence, new streams for customer engagement.

Operational Processes Digitalization

This digitalization helps you to optimize all internal processes, including those that aren’t directly connected with customer interaction. The big role plays automation solutions that will

relieve the employees from repetitive tasks and reduce the number of errors caused by human factors.

So, a lot of back-office operations can be enhanced for better business performance.

Customer Experience Digitalization

Digitalization can bring your customer services to a whole new level through several aspects. First, we have already mentioned: generating more volumes of health data and leveraging it for the customization of insurance plans.

The second will include communication improvement, which would allow insurers to stay in more close contact with clients and assist them more rapidly and more efficiently than ever. Innovative technologies allow insurers to make their services more customer-oriented, more inclusive, more accessible, and more relevant.

The Main Health Insurance Technology

So, what technologies are relevant for the health insurance and healthcare industry?

🤖 Artificial Intelligence and Machine Learning

The usage of artificial intelligence (AI) and machine learning (ML) is pretty wide in health insurance. Altogether, the insurance industry is data-based, and AI/ML helps to generate business value from big data insurers get.

Discovering behavior patterns in customer behavior, automating underwriting and claim processing, detecting fraudulent activities, implementing AI chatbots for communication with clients, and risk assessment — basically, AI/ML will renovate these functions within the company.

📡 Internet of Things

Among different insurance companies, the Internet of Things (IoT) is used to collect more valuable data to create a more precise underwriting or to assess property damage during and after an insured event.

In health insurance, IoT-powered wearables are the main tool. Through them, health insurers can monitor the health state of the client and detect even unnoticed health issues before they transform into serious illnesses.

⌨️ Digitalized Data Systems

Bureaucracy is still big in the healthcare system, and this is a challenge not only for insurance companies’ employees but for doctors and clinics as well. Inquiries, forms, documents can still be a responsibility of a doctor who would better dedicate more of their work time to their patients. At the same time, there are other types of documents that should be processed, like patient records, etc.

Digitalizing this data and uploading it to special data systems will be key to improving document management and increasing data accessibility, which will simplify lives for all parties involved: insurance companies, doctors, clinic management, and patients.

📱 Mobile Solutions

We become used to handling our business through smartphones. If the company hasn’t adapted to mobile, it has zero chance to survive in the nearest future. The insurance industry isn’t an exception: more and more insurers launch mobile apps for their clients.

Insurers might use client mobile apps to manage all client services there, e.g., accept claims, and payments, provide online consultations with healthcare specialists, etc.

Altamira’s Experience in Health Insurance Digitalization

After our overview of digital transformation, you might think: it all sounds great, but how can I actually start transforming my insurance company, if we have zero relevant experience? The most simple and efficient way would be to delegate the task to the vendor with relevant expertise, like Altamira.

For more than a decade, Altamira delivers digital solutions that help businesses innovate their business processes and gain a competitive edge. We have cooperated with a number of healthcare and health insurance companies and developed software systems that contribute to the digitalization of these industries.

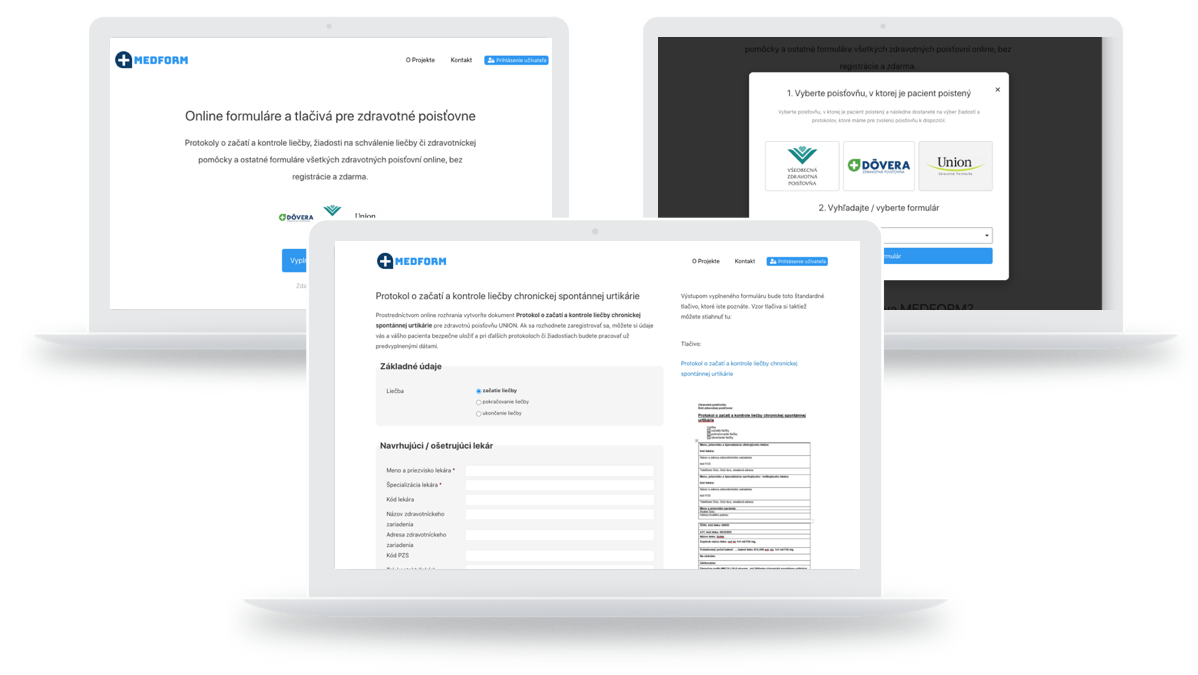

One of these projects has become Medform, a unique data system aimed to digitalize processes for health insurance institutions. We asked our developer Adam Vozar who contributed to the system development, to share the main insights that might be useful for other insurance companies building their digital transformation strategies.

Case: Medform

Medform is a project aiming to digitalize such parts of medical bureaucracy that were sidelined so far, like treatment initiation and supervision protocol (with various oncological conditions), application of pre-approval for treatment, or any other applications or requests required by health insurance institutions and revised by medical examination boards.

The main technical challenges

At the beginning of the entire digitalization process, we needed to obtain all official documents from the websites of health insurance companies. Most documents are in DOCX, PDF, or RTF format. Later, we needed to manually open each one of the documents and manually replace all the form items with our own variables.

Then, it was necessary to create a form at the backend of our system that would correspond 1:1 to the form we are trying to digitalize. This form will be presented to the user and user inputs will be filled into it. In order for the system to correctly include the user inputs in the final document, we used data mapping of form items and our own variables. Until today, we have managed to digitalize almost 200 forms belonging to 3 insurance companies in Slovakia.

The choice of technologies

For this type of problem, we chose the open-source framework WordPress built on the PHP language. This framework supports the addition of plugins that greatly facilitate the process of creating a website. For us, the most important plugin was GravityForms, thanks to which we were able to speed up the digitalization of all documents.

During a more detailed analysis of the documents, we found that some fields in the forms, e.g., patient’s name, address, medications, etc. are regularly repeated in the forms. To speed up this manual work, we used an algorithm that, after manually clicking on the form, automatically detects whether the given field has already been used in the previous digitalization process of the form. Thanks to that, we saved a lot of time.

Must-have functionality for this type of project

Forms very often contain inputs on diagnosis, drugs, dietary food, and medical aids. These attributes are mandatory items in the forms and can change over time, it was necessary to keep the database of these always up to date. For this reason, we decided to monitor these data at regular intervals from publicly available websites. We also ensured the validation of the birth number of the patient and the doctor. When filling out the form, the user can see a preview of the original form and also is able to download the original form and later be modified. You can also register in the system. After filling out the form for the first time, basic information about the insured person is entered, which is then pre-filled when filling out new forms.

In Conclusion

The digital revolution has arrived, and you want to stay successful in the ever-changing reality of automation, artificial intelligence, and other advanced technologies. It might become a vast change, but it will lead only to positive outcomes, increased revenues, and a great brand image. And while you are hesitating, your competitors are most likely to have already implemented a wholesome digital strategy!

FAQ