Table of Contents

Modern companies are striving to become more data-driven. Consequently, they have to understand the basics of data interpretation, methods of data movement, and application as well as learn the models allowing them to gain valuable business analysis insights and achieve meaningful results. Thus arises a need to continuously and scrupulously update data models.

Hiring highly qualified data scientists is a rather challenging and daunting undertaking for most in the modern job market. Moreover, it’s become less effective with the rapid evolution of technology. Aiming to bolster their capabilities and improve relationships with clients, businesses nowadays face the challenge to organize and process various types of unstructured data. Data science in finance enables the extraction of valuable information from a tremendous amount of unscaled (raw) data; thereby improving the risk management profile as well as making effective financial decisions.

In this article, we are going to uncover the potential of big data science in finance and discuss the top financial data science applications in business.

What is data science in finance, and how has it reinvented the field?

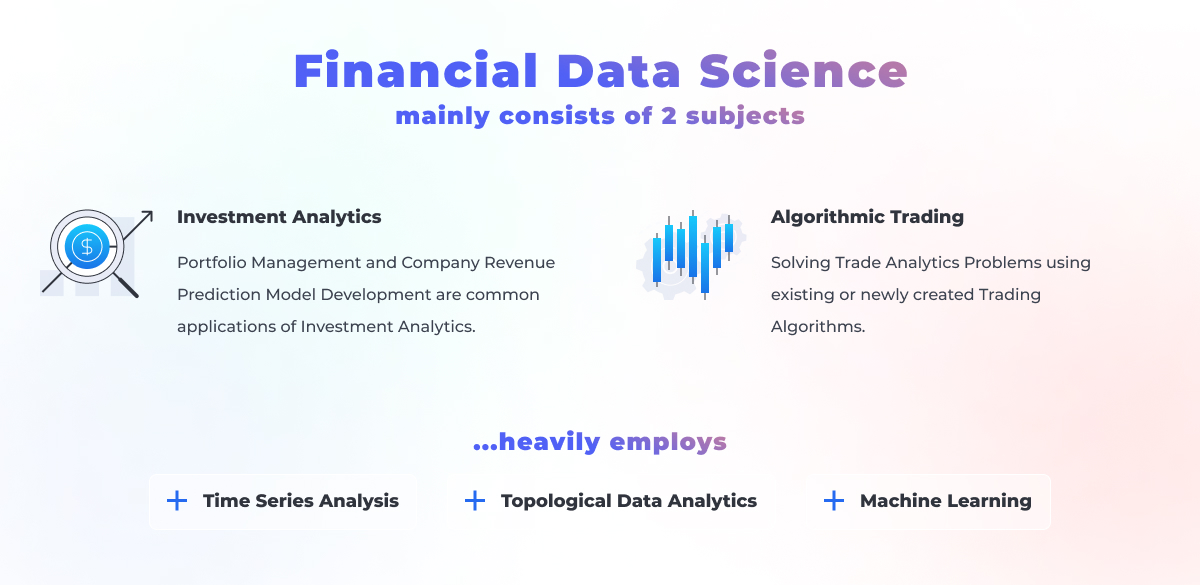

In general, data science stands for a set of methods, tools, and operations enabling to perform deep data processing, extract key information and trends as well as draw valuable conclusions. It is a vector of financial analytics that uses statistical methods to understand and best solve problems in finance. Through the time of its existence, big data science has proven to be a groundbreaking field of technology, enabling industries to introduce changes to implement revolutionary updates. Thanks to relentless tech revolutions, machines can nowadays keep themselves informed and running even without pre-set algorithms. Big data science in finance is built on basic knowledge of mathematics, statistics, computer science, graphic design as well as specific methods and algorithms. It enables to use the data efficiently, extract the most valuable lessons, and tackle serious business decisions based on evidence.

Big data science in finance is built on basic knowledge of mathematics, statistics, computer science, graphic design as well as specific methods and algorithms. It enables to use the data efficiently, extract the most valuable lessons, and tackle serious business decisions based on evidence.

Let’s take a closer look at the fundamental reasons why there is so much noise and buzz around data science. The practical value of data science in finance, for example, is that it enables businesses to establish better relations with customers, predict and minimize the financial risks, expand capability and increase revenue by implementing data-driven tools.

Implementation of data science in the fintech industry requires domain knowledge in financial markets, risks analytics, quantitative methods, hypothesis testing, linear regression, time series analysis, simulation methods, machine learning models, programming languages.

Towards Practical value of Data Science in Finance

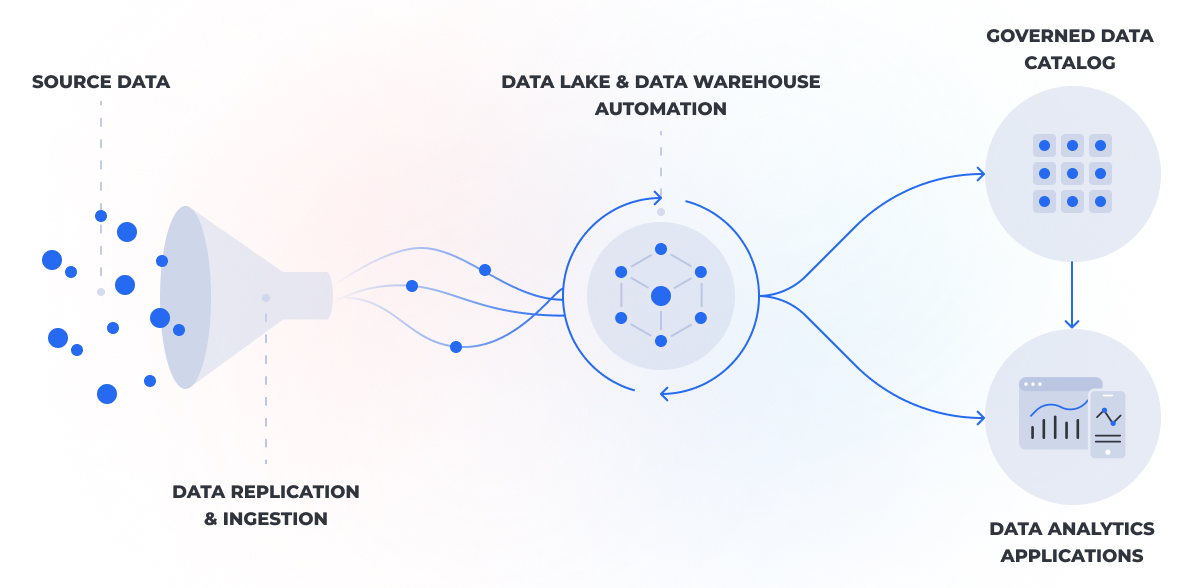

Data science in finance enables to perform continuous information analysis without human interaction. Experts in analytics utilize various analytical programs: Machine learning, Deeps Learning, modeling algorithms aiming to build connections between existing models, incoming data, received information that points to a different direction than the status quo, making sense of it all, and making predictions for the future. Global industrial companies need data science in finance to be able to access new markets and scale their businesses. It enables to effectively use data to support significant business decisions as well as fundamentally transform the decision-making process so that it will be built on hard statistical numbers and concrete evidence rather than speculation.

Here are the cases of successful data science application:

Steps to extract valuable data:

Top 10 Apps built on data science in finance

Big data is a booming technology offering new opportunities for the fintech industry. We have already covered the key points concerning data science in finance, and now let us move on to discussing its practical value and possible application. Since companies are always ready to invest to get insights about their customer’s behavior in order to then build predictive models, there already exist a variety of Apps built on data science. Let us discuss 10 of the most popular such data science Apps that enable businesses to strategize their efforts and investment, to enforce productivity, and drive profitability.

Modern advanced technologies, including AI and ML assist in tracing the activities of users and in collecting data, while analytics assists greatly in its appropriate decoding, structuring, and extracting of the needed information. As a rule, data analysts prefer web-based or desktop-based software aiming to trace the user’s actions and behavior. Thus, let us see how the functionality of such apps is organized and how data scientists can benefit from their utilization:

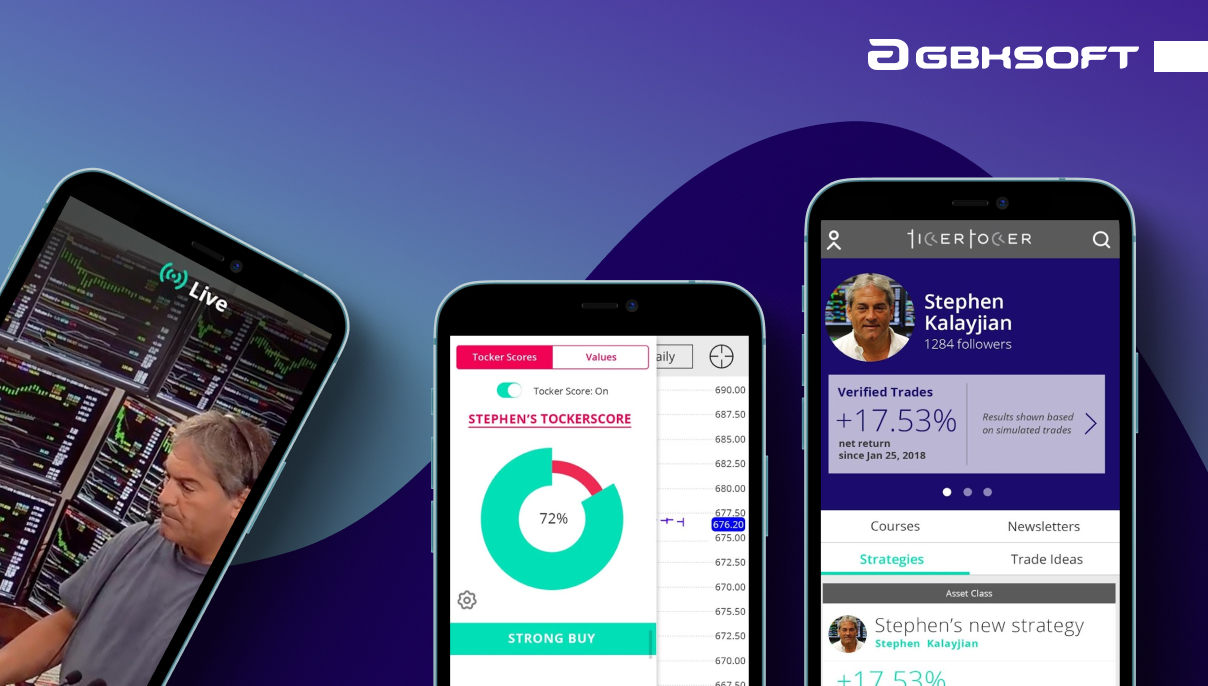

1. Ticker Tocker Trading Platform App

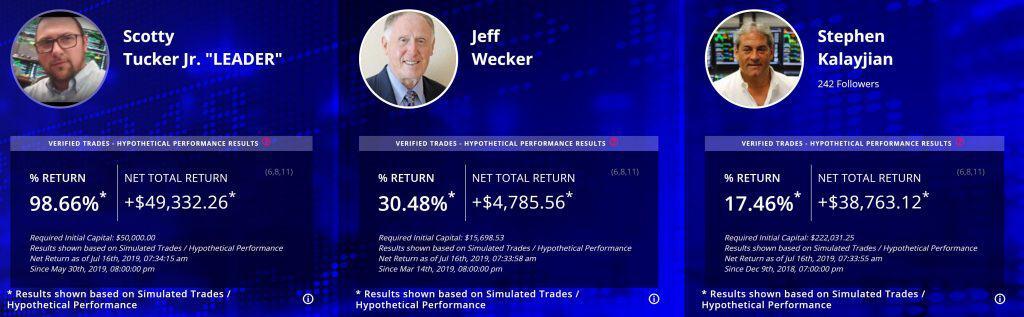

Purpose: Multifunctional trading App for those who want to rapidly react to changes and immediately adapt to the unstable and volatile environment of the investing world. A truly innovative application with rich functionality, the app was designed to help retail and professional traders to quickly find, test, learn, share and execute trades. Altamira took part in building this App and has gained a considerable amount of valuable experience enabling us to continue to deploy high-class solutions based on data science principles.

Features:

- The unique design of visual charts, which can be adapted according to the visual preferences of the end-user

- A user may choose a criterion and time period of their interest, and the relevant data (real-time or historical) will be plotted onto a chart for a financial instrument of choice.

- Access to big data volumes, sorted, analyzed, and compiled into comprehensive tables.

- An ideal instrument for those who want to make the right trading decisions based on the extracted analytical data.

- Social Media Integration, Instant Messaging, Trade Bar, Analytics Tools, Filtering tools, Advanced Search, etc.

Purpose: allows business owners in the fintech industry to access all of the data, from anywhere, anytime, transforming the way their company uses the data.

Features:

1) Allows to raise the productivity of employees, allowing rapid business growth;

2) Making Einstein-powered predictions;

3) Native mobile experience;

4) Easily organize and access the data insights at any time.

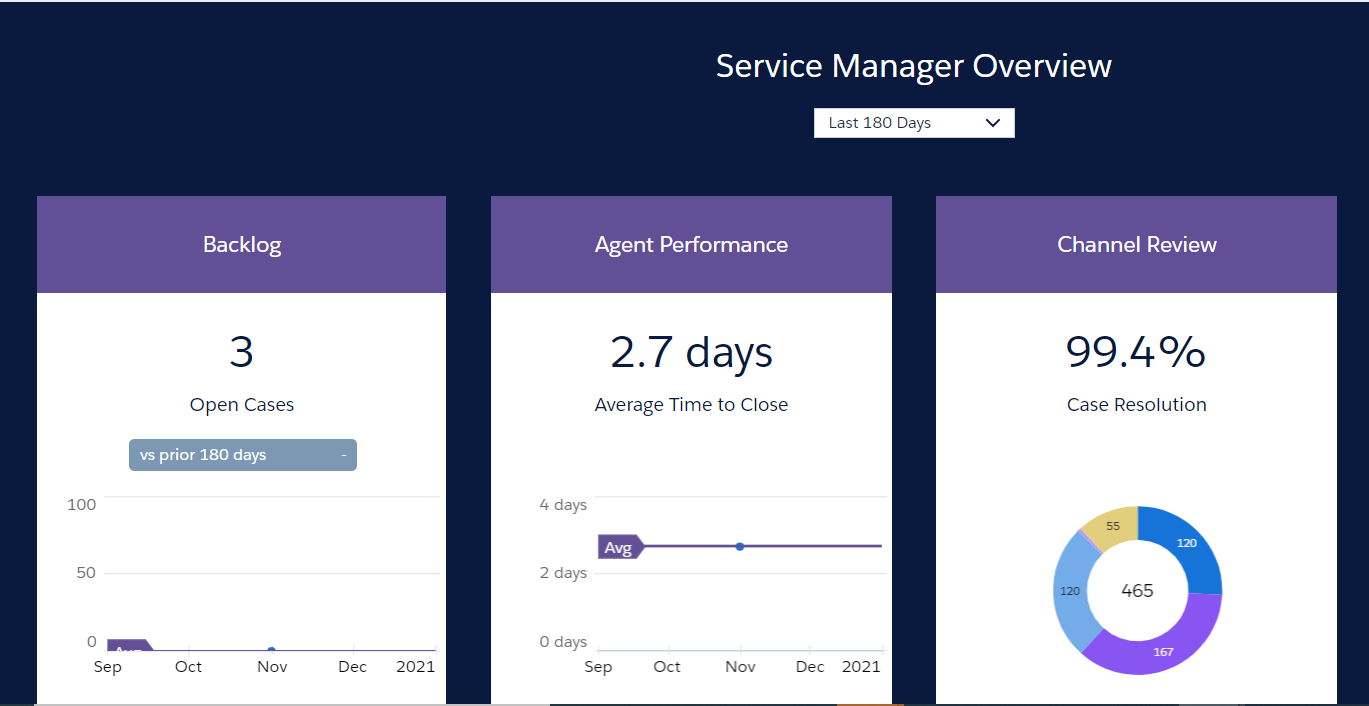

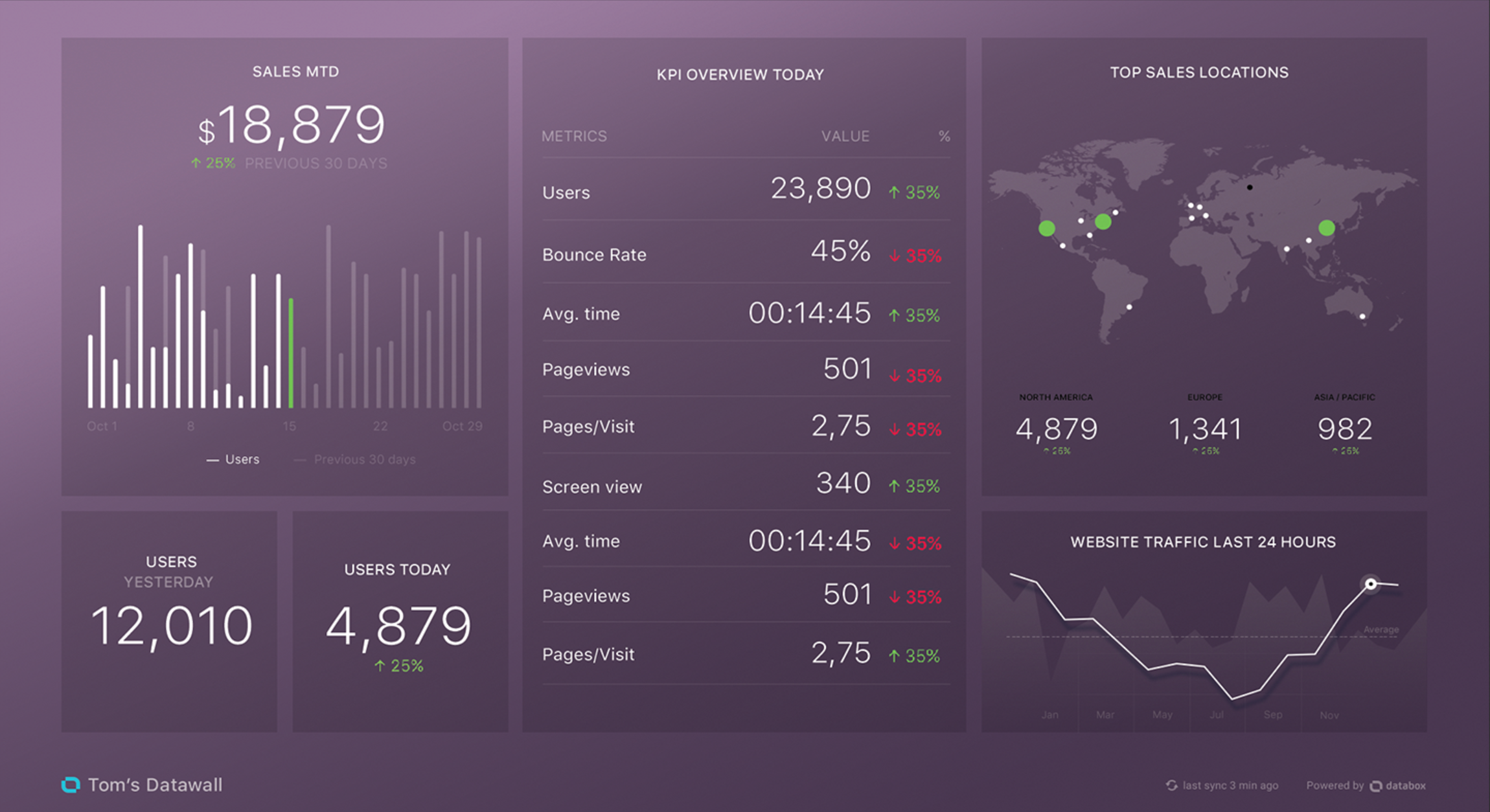

3. Databox: Analytics Dashboard App

Purpose: is a mobile-first business analytics platform based on data science in finance designed to assist in understanding the shape that your business is in.

Features:

1) Connect cloud data sources, spreadsheets, databases, and custom integrations to organize all of your business KPIs in one place;

2) Create personalized dashboards enabling the discussion data via Slack;

3) Support multiple devices and platforms;

4) Enables instant access to all data insights enabling you to trace the current situation with your business.

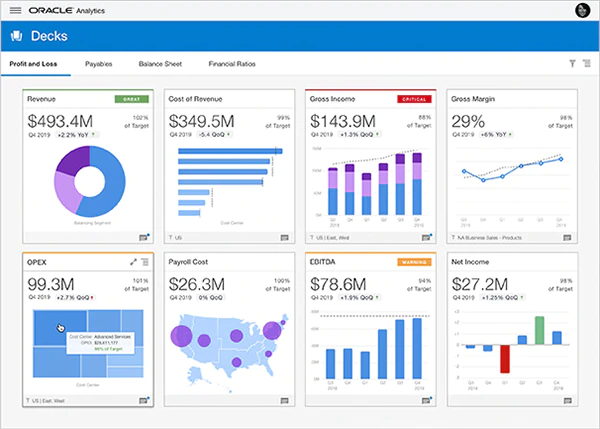

Purpose: provides industry leaders and analysts with a one-stop-shop where they can find, open, and interact with all their high-quality curated analytics content based on data science in the fintech industry.

Features:

1) Instant access to your business’ analytical data;

2) Adaptive layout enables to instantly optimize the data for your device;

3) Create a project immediately and access it any time you need;

4) Summarized dashboards in automatically generated podcasts using the unique cloud capability.

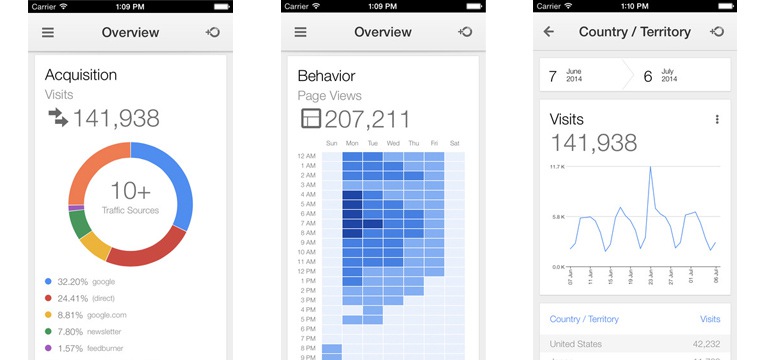

Purpose: possesses a wide range of tools to monitor any business analytic properties keeping track of the desired issues at any time.

Features:

1) Ability to analyze the key metrics in built-in reports;

2) Keep track of real-time data;

3) Compile individual reports utilizing the variety of metrics and dimensions;

4) Save your reports with the adjustable dashboards.

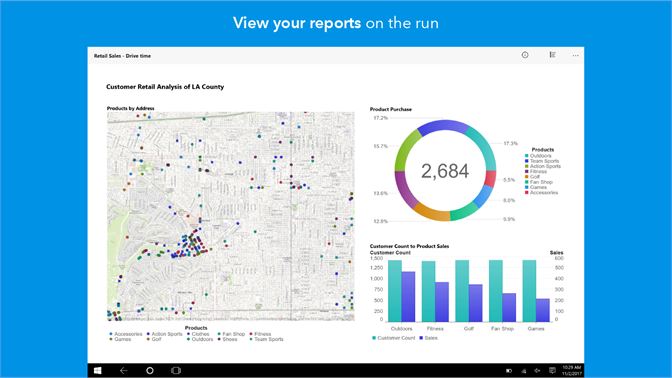

Purpose: enables you to keep track of and interact with reports that can contain a variety of charts, graphs, gauges, tables, and other report objects.

Features:

1) Adjustable multi-touch gestures allowing to easily and swiftly move through the app;

2) Create, filter and drill into your own data reports;

3) Make valuable decisions based on the data attained by the app’s algorithms.

7. MyWallSt: Learn Stocks, Invest App

Purpose: comprising the tools, guidance, and analysis you need to research companies, pick stocks and make intelligent investing decisions

Features:

1) All the needed data in one place facilitating learning about stocks;

2) Ability to build your personal stocks and create a portfolio, track it as well as the individual tickers that comprise it;

3) Replaces the usual investor’s paperwork and eliminates risky trading strategies;

4) Access to investment insights you can trust.

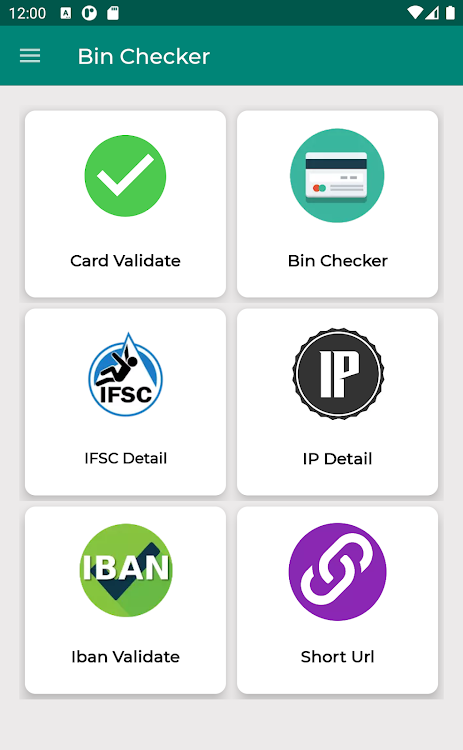

8. Bin Checker – Check Card Information App

Purpose: Bank BIN database allows you to search the first 6 or 8 digits of a credit or debit card bin number to detect frauds and scams.

Features:

1) Tech solution that helps prevent online fraud and decrease the dangers;

2) Enables to detect whether the credit card is real;

3) You may easily avoid the fraudulent transactions, chargebacks (credits), new card issuances and spare all of the associated discussions with customer support agents – thereby saving your precious time;

4) Ability to check and perceive whether the client is real.

9. OurCrowd – Equity Crowdfunding App

Purpose: Global equity crowdfunding platform for accredited investors to invest in global startups

Features:

1) Enables to build a diverse portfolio of equity in startups and funds;

2) Get instantly notified when the best investment opportunities become available;

3) Browse the curated startups and make good, profitable investments based on the info extracted from data science in finance;

4) Review the status of your portfolio at any time at your fingertips with the help of a smartphone.

10.Zoho Analytics – Mobile BI Dashboards App

Purpose: App was built to trace the main business metrics, quickly detect the needed info, giving business owners the ability to make business decisions based on data science in finance, and enabling them to extract the needed analytical insights.

Features:

1) Mobile BI;

2) Analytics software on the cloud;

3) Enables management to keep track of key business metrics;

4) Collaboration within the company.

Extracting the most valuable data insights, offering the development of the best solutions

Altamira has been a stable and powerful technology supplier for over 10 years. With refined expertise through years of experience on the market. It has been steadfastly supplying reliable technology for various industries, allowing entrepreneurs to balance risks, value, and technical feasibility.

Benefit from a professional and secure technology provider:

- Unique philosophy inside the company;

- One of the top developing companies on Clutch, having already won a large number of awards;

- Passionate individual approach to each project;

- Discovery stage;

- Agile and scrum methodologies;

- Strictly sticking to NDA policy;

- Instant communication throughout the whole project development cycle;

- Continuous technology support;

- Unique interactive UX/UI designs;

- Altamira utilizes the productive methodology of building MVP providing a highly interactive user experience.

- Guarantee of absolute security.

Altamira has proven to be a reliable and powerful technology supplier. Not only can we offer fintech solution development from scratch, but also the redesign and modernization of existing business technology solutions. Our Business Analysts always conduct in-depth research, help define the best possible list of features and the most suitable technology stack to use. We have a profound experience working with both startup projects as well as big, established financial companies. It has allowed us to gain the unique experience and professional knowledge that we now indeed possess.

By choosing us, you get considerable benefits, such as:

- Get the desired fintech solution without development risks and hidden costs;

- Extract the real practical value that data science brings out;

- Data science innovation will give you a considerable competitive advantage in 2021.

Here is the approximate estimation of our projects:

| Stage | Dev hours | Dev cost |

| Specifications | 111 h | $2664 |

| Design | 78 h | $1560 |

| HTML/CSS | 329 h | $9212 |

| JS Development | 328 h | $9840 |

| PHP Development | 826 h | $24780 |

| Testing | 383 h | $6894 |

| Admin | 29 h | $580 |

| Scrum Master | 332 h | $6972 |

| Total | 2416 h | $62501 |

Successful experience in data science application

At Altamira, we have built a functional and beneficial App for traders based on data science in finance. One of our latest successful projects is a truly innovative trading application with high-end functionality.

The Ticker Tocker Trading Platform App is the mobile application version of the popular web trading productivity platform designed to help retail and professional traders to quickly find, test, learn, share and execute trades.

We clearly defined the client’s objectives and understood their deepest desires for the app. Our experts took a deep dive into the stock market specificities, processed and analyzed large amounts of data to realize the most valuable info that may turn into beneficial App features.

Here is the list of unique options we ended up integrating:

- The unique design of visual charts, which can offer individualized design to improve the user experience and make the App interface more interactive and personable.

- The App opens to its users access to the summarized data gathered based on many indicators in the form of a comprehensive and intuitive data table.

- Subscription to top traders to get inspired and motivated by their success story

- Other beneficial functions such as Social Media Integration, Instant Messaging, Trade Bar, Analytics Tools, Filtering Tools, Advanced Search, etc.

Altamira has been working on this project as a dedicated team. The dedicated team was fully focused on the IT solution, while the client controlled the workflow and had the opportunity to switch attention to high-level tasks. The QA service provider was responsible for attracting new specialists and administrative support to the team.