The fintech industry is not one to stay still; each year, we observe a new boom of fintech technologies, applications and companies. And since our team regularly develops financial software, we’ve decided to explore the market and discover what types of apps are on top.

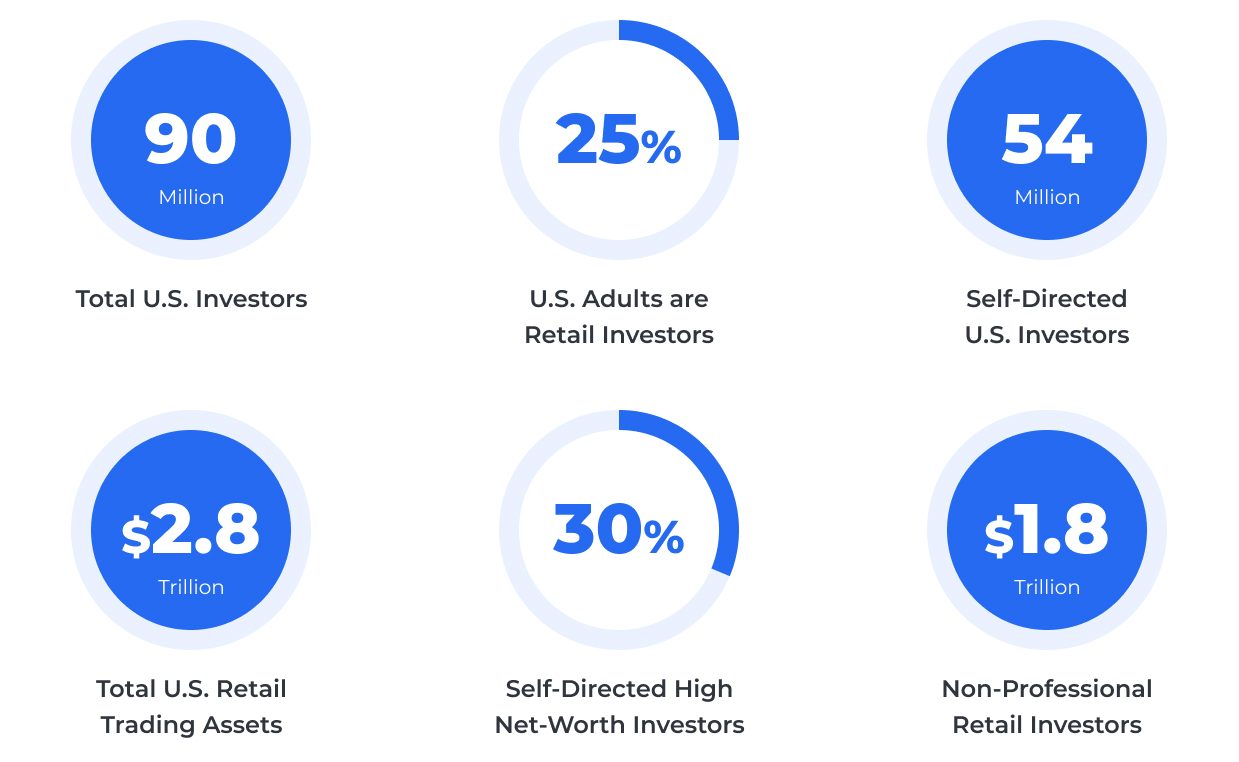

This trend demonstrates that the number of people who actively buys and sells stocks online has grown as well. According to Forbes, individual investing has become prevalent, and as of the time of writing of this article, there were 54 million active investors in the US alone. Here are some other interesting investment-related statistics:

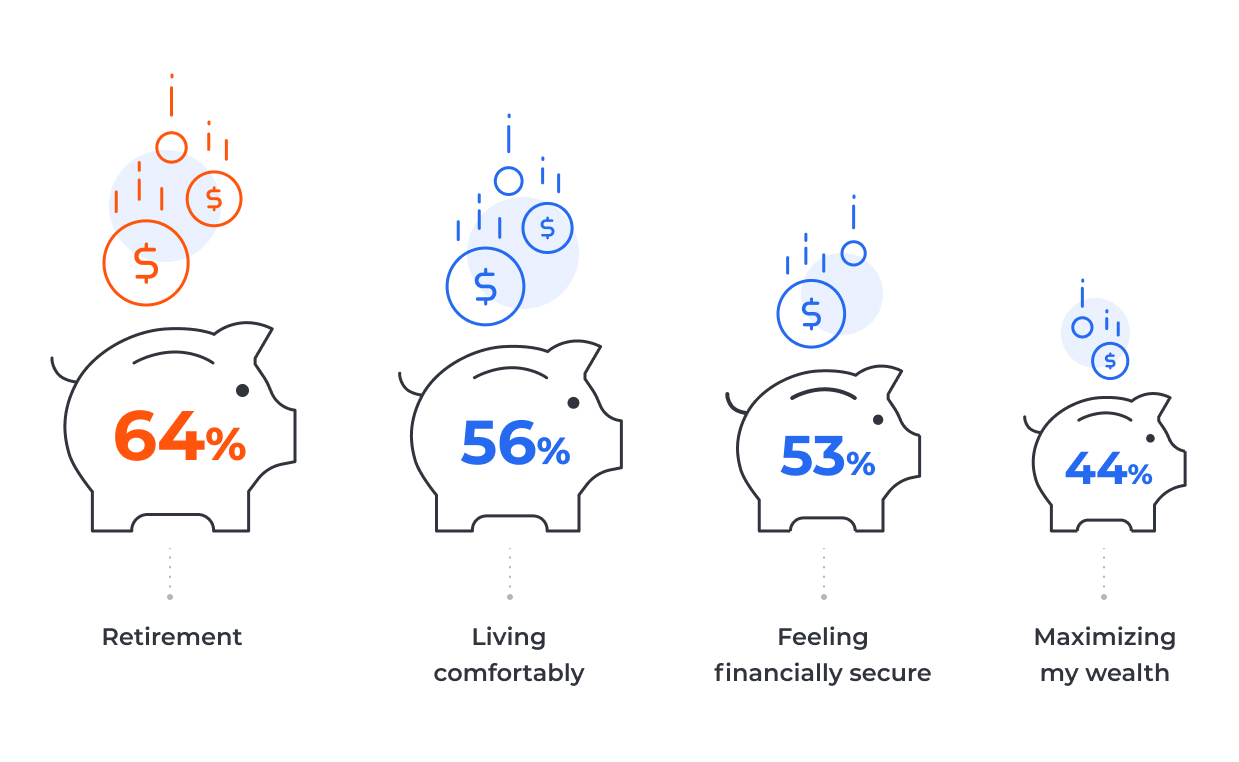

Even more interesting is that the millennial generation and Gen Zers show significant interest in investing and trading, respectively (at least for now). According to a recent survey that included 1405 respondents, the number one reason why most millennials (64%) are ready to invest is to achieve financial independence and retire comfortably. Apart from retirement, there are several other reasons why younger people are eager to invest and take calculated risks. Here they are:

So, as you probably understand, there is a significant demand for new, high-class online investment platforms. But what makes a great investment app?

We will describe key types of investment apps and their prevalent, popular features, their development process and cost, and how they can bring you money. And, without further ado, let’s get started!

Main types of investment apps

When it comes to investment app development, many businesses and entrepreneurs get stuck with the question: “What kind of solution should we build?”

To help you with your difficult decision-making process, we’ve decided to share our knowledge and experience and describe key types of investment apps that are extremely popular in 2021. We will also cover traditional and alternative investment and their specificities and name some great examples you can take as inspiration material.

Investment apps

A public investing app is a solution that offers a digital platform for independent investment. This means you do not need a broker or financial advisor to help you make investment decisions and complete investment operations.

What’s great about investment apps is that they are multifunctional and approachable, and even a beginner can easily learn how to invest. Some solutions even offer digital advisory services, making learning everything you need even easier.

Among great examples of investment apps are solutions such as Acorns, Robinhood, Betterment and Invstr. A common element in all of these solutions is that they are incredibly user-friendly and offer personalized approaches to investing. We’ll get back to these solutions later and discuss their successful functions and metrics in greater detail.

Must-have features

Suppose you find a digital investment platform appealing and feel that it would align with your business vision. In that case, the first thing you should consider before initiating the development is the specifics of your feature set for your future application, be it mobile, desktop-compatible, or both. We have collected some key options you might like to add:

Money management tool: Users will appreciate the pleasure of being able to handle their funds and manage their investment portfolio.

Reporting: Who does not like to be in control of all financial operations? We can say that every user will appreciate consistent daily/weekly/monthly report capabilities on investment, growth, credit, and other financial metrics.

High level of app security: There is so much data used by investment apps, so just imagine how uncomfortable any breaches would be. Encryption algorithms and two-factor authentication are a must!

Investing options comparison: It is crucial to offer a comparison tool to help you choose the best possible investment option. Investors are picky, and you need to offer diverse functionality to keep them on your platform.

Real-time alerts: if something critical or suspicious happens, your users should get a notification instantly. This will help them stay updated with investment and returns information, get the best offers and discounts, and report suspicious activity related to their account.

Banking apps

Needless to say by 2021, most things have shifted to mobile operations, and banking is no exception to that trend. The ability to create banking apps lets you benefit remotely from all banking services, including micro-investment opportunities.

Modern banking apps powered by the latest technologies offer numerous saving opportunities and advanced savings trackers. They are perfect for people who still want to invest money but are unwilling to take major risks.

Several great banking apps, such as Ally Bank, Wells Fargo, and Bank of America are widely used. These solutions let their users benefit from investment optionality, building out their own investment portfolios, working with dedicated advisors, and even choosing different ways to invest and comparing those strategies.

If you’re wondering what separates great banking app solutions from not-so-great ones and what options users appreciate the most, check out the video below.

Banking apps are great solutions to build, and they can be called the future of the finance industry. So, if you are interested in this kind of solution, you can check out our blog post and find out what feature set is perfect, how much money investment banking app development will require, and what value it offers.

Stock Trading Apps

Stock exchange trading applications let users easily participate in stock trading. All users can buy and sell stocks effortlessly, create and manage their stock investment portfolios, choose and change appropriate strategies and consult with more experienced traders. Speaking about how to work such an application, it is quite typical and includes several key steps that traders have to follow:

- Complete registration and link bank account;

- Set up your type of trading account based on things like your willingness to commit funds to the account and your answers about your level of experience as a trader;

- Select a one-time or recurring deposit schedule;

- Buy stocks or other investment vehicles when they are traded;

- Sell the stock when it is the best time to do so, but don’t forget to consider taxes.

Based on our experience, we can say that this type of investment application is the most profitable one that is always in demand. Usually their owners charge commissions on trading (explicit or implicit through payment for order flow), deposits, withdrawals, and share transfers to a different institution.

So you can imagine how profitable trading apps can be and are even after explicit commission on trading has been slashed to $0 across the industry in the U.S.

Second, if you have a license for trading software, protect your users’ data and follow regulatory rules, you can be sure that this solution will keep bringing you money for years.

Thirdly, trading apps are on top at the moment, and there is still space in the market for new innovative solutions that can attract an influx of traders outside of the U.S., but likely even domestically.

As we’ve already mentioned, the Altamira team has a lot of experience in building trading applications. We discovered all possible pitfalls and bottlenecks, applied various approaches and strategies, and, after all challenges, built a solid number of solutions for trading. If you are wondering how the development goes and what every trading platform has to contain and offer, then read our post dedicated to trading app development.

Must-have options

There is a range of important features that should be present in your solution:

Personal account: it should be easy to set it up, connect a bank account and manage all preferences.

Advanced analytics: this option will help traders observe transaction results, analyze them and as a result simplify portfolio creation, trading and investment process.

Well-organized newsfeed: all traders need a reliable source that aggregates fresh company-specific news on such events as initial public offerings, regulatory scrutiny, lawsuits, earnings releases etc.

Assess management tools: we could not emphasize enough how important it is to provide users with easy to use tools. They should be able to trade stocks and ETFs seamlessly and the tools must be intuitive.

Tutorials and manuals: if your goal is to attract as many traders as possible, then you should make your platform good for both beginners and professionals.

Mobile version of app: it is not a secret that these days people use mobile devices more than their computers.

User experience design: great search bar functionality including news aggregation capability, top popular company lists, with different categories and criteria.

Сryptocurrency investment apps

Although there is a lot of debate and controversy about the direction and footprint of cryptocurrencies, there is no denying or doubt that it has taken the finance world by storm and topped the list of the most hotly contested and, by extension, most discussed topics in the modern history of the finance world.

It is hard to underestimate its influence on the economy, since even some stores, including food places and sports venues, and, for a brief moment, Tesla in the U.S. started accepting cryptocurrency as a payment method for their goods and services. Therefore, it’s finally starting to settle in and be implemented as a medium of exchange in addition to transaction and lending, as in the case of Ethereum.

There are different types of applications offering exposure to investing in cryptocurrencies, and the top solutions are among the most popular and trusted software in the finance market as a whole despite the decentralized nature of the space, i.e. being far removed from regulatory safety and security.

The main sticking point is the storage of the coins; many preferred storing them on internal/external computer hard drives, but this faced its own set of cons since stories surfaced of people losing hardware, and it getting stolen or thrown away. On the other hand, storing it digitally has its own pros and cons, such as remembering and restoring passwords, being prone to cyber theft, who have arguably become more adept, nimble and profitable than larceny criminals.

In terms of the types of cryptos, the main distinction is between:

- “stable coins” that are pegged to currencies and are a step towards development of e-currencies such as digital dollar.

- Mainstay cryptos, which were traditionally Bitcoin and now seemingly also Ethereum

- Altcoins

The price of Bitcoin experiences immense volatility, high liquidity and is, on the other hand, one of the most stable cryptocurrencies and highly traded. Therefore investment opportunities are endless.

While traditional public financial markets are trading in an overwhelmingly zero interest rate environment, people are still paying fees and commissions to trade cryptocurrencies, making the space more compelling for potential entrants. But remember, if you are reluctant, you can also be more of an all-around financial trading app like Robinhood, giving access to trading all sorts of different investment vehicles.

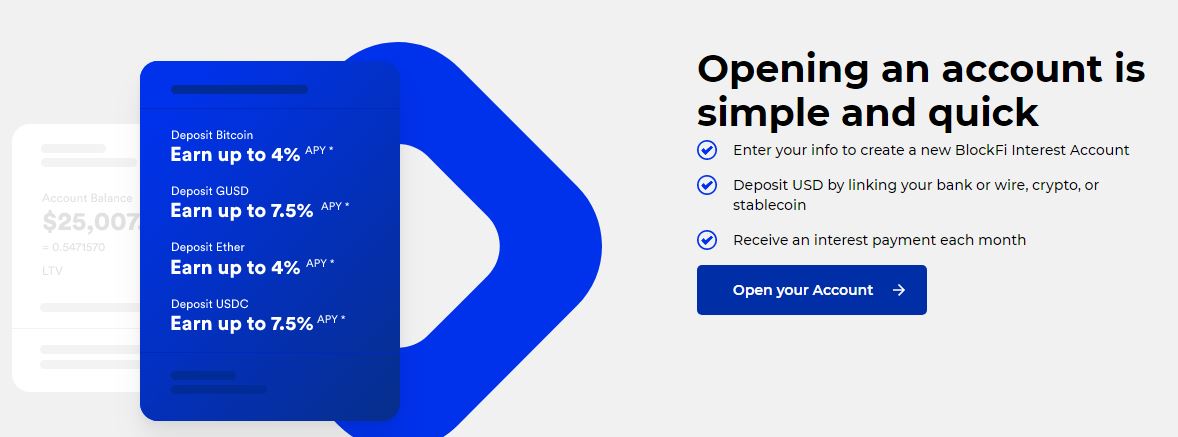

We have explored the market and found some great cryptocurrency investment solutions. One of them was BlockFi, which lets you earn interest at up to 7.5% on your balance without any hidden fees and, of course, buy and sell crypto easily. Here is what it offers:

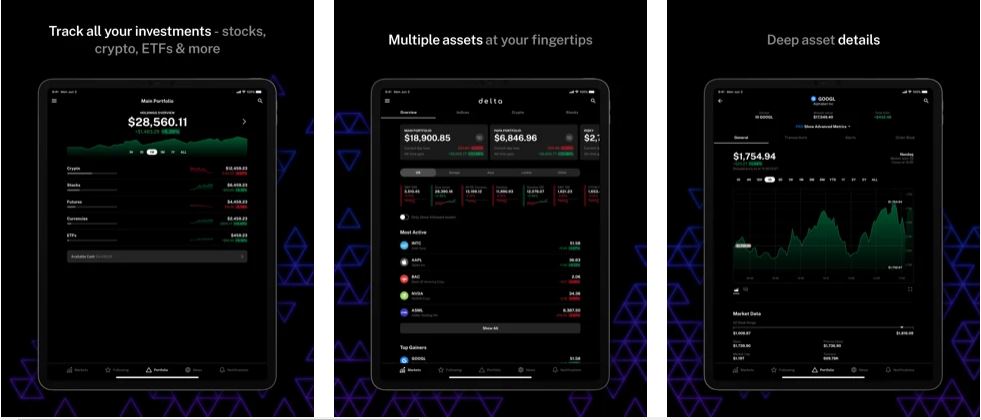

Apart from the solution mentioned above, we discovered one more separate category, which includes investment tracking applications. For example, an app called Delta is perfect for multi-asset tracking. It shows live prices of all cryptocurrencies and even lets you track stocks, ETFs, forex, bonds and many more. It is a multifunctional ,all-in-one investment tracker that every millennial will appreciate.

Image source: Delta

Interested in the latest trends in investment app design? Then, we have a special blog post for you. Check it out to understand key aspects of investment app usability, proper brand image, and what design trends should be followed in 2021.

Features to consider adding

No cryptocurrency investment solution cannot exist without the key functionality that includes but isn’t limited to the following options:

Cryptocurrency purchase: to encourage your users to sell and buy more you need to organize and relay all that transaction-related info properly and offer one simple “request a deal” button.

Cryptocurrency converter: incorporating a cryptocurrency converter lets your users perform easy conversions if they need to.

ID verification: a security matter that prevents unauthorized investment app usage and helps to structure and sort all real app users by their names or other categories.

QR codes scanner: this feature can be used to ensure convenience of payments and provide additional security.

Auto-cancellation: to avoid any payment and transaction issues, it is preferable to offer auto cancellation (on grounds of suspicion of duplicate charges) that will complete one transaction and will not charge the user if he or she accidentally ”over-clicked” the button.

Building an investment platform with Altamira

Investment app development includes several key steps, and the first and foremost preliminary is holistic research. The Discovery stage will let you find out all of the unknowns, polish your app idea and select the most suitable feature set and tech stack to make it.

Discovery and research

So the first advice we’d give you is to explore the market, select the most proficient feature set for your investment platform, write specifications and spit your app development into epics. This will help you minimize development risks and predict development outcomes.

As to the other specialists, you will need to engage in building your investment app, we would recommend you hire a team like ours that has the following technicians:

- Designer;

- Back-end developers;

- HTMLCSS coders;

- Quality assurance specialists;

- Scrum Master.

Each specialist is responsible for a certain stage and part of your project and will help you achieve the best result. The development stages your investment app will go through are the following:

Design and prototyping

Our designer offers a concept and several options for interfaces, colour combinations and layouts.

Coding

Once you’ve agreed on the app design and concept, the development itself starts. Our tech takes to writing high-quality code, integrating all necessary APIs, implementing all options and connecting necessary services.

Testing

After each development milestone, our QA specialist checks if everything is in order with the developed part of the solution. They check everything, starting with performance and obvious bugs and ending with ensuring clear, necessary compatibility.

The testing can be manual or automated. We at Altamira often use both to detect and eliminate all possible issues at early stages, which helps us deliver projects fast without compromising their quality.

Release and maintenance

When your solution is all set and ready, we submit it to stores, check if everything is okay after the first release and influx of users and can help you improve your solution further if you choose our maintenance options.

Our experience with investment platform development

Here at Altamira, we’ve developed several big projects related to investment. Among the investing solutions that we’ve created, you can find the following:

- Complex investing platform that allows users to manage their finances and build up advanced reports with an all-in-one tool. This project was a real digital helper for a company that developed it with us.

- Algorithmic trading software that has both web and mobile versions and helps its users research market trends and opportunities, create custom trading strategies, set up personalized chart views, connect with brokers, and engage in automated trading. You can look closer at the case study in our portfolio, which describes this solution in detail.

- Holistic database for investment bankers that collects, systematizes and helps to find easily all information about various firms. Currently, this investor database contains information about more than 4000 firms and helps middle market investment bankers, corporate business development executives, and business owners explore potential capital raises.

- A platform for cryptocurrency exchange uses which people can purchase or sell digital currencies for dollars and other digital assets. This cryptocurrency exchange platform offers users the ability to trade in 5 virtual coins and exchange dollars for virtual coins.

True Cost of Investment Platform Development

The final price of investment app development will depend on several key aspects.

The first one of them is the selection of the platform. The price of desktop and mobile applications (per platform) will surely differ.

The second factor influencing the price is the feature set, app complexity and integrations. The more complicated your desired feature set, the more time and resources it will take to develop and implement the solution.

And last but not least is the presence of ready-made modules, which can make your solution less expensive. The approximate price of the investment application can be $50,000 – $75,000.

We’d like to remind you about one great opportunity to launch your project if you are on budget – it’s MVP development. If you choose it, your investment app will be full of basic yet useful features. MVP is a great opportunity to initiate the development and test your idea and users’ response while committing less sunk costs upfront immediately.

Best Examples of Leading Investment Platforms

We have already mentioned several good solutions related to each investment app category. But now, we want to dissect two of them in detail because they can serve as great examples and inspiration material for you. Both of them are very successful, feature-rich and widely used. And we are referring to Acorns and Robinhood. Let’s take a closer look at each of them and see what makes each great.

Robinhood

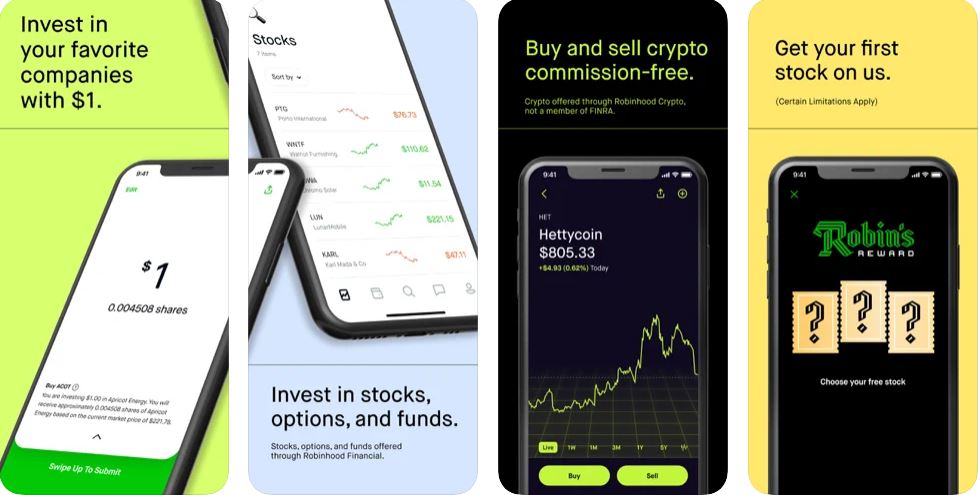

Image source: Robinhood

Like many brokerages, it offers a free, cheap stock for beginners. But what makes Robinhood so unique apart from the fact that it pioneered a commission-free trading platform for everyone in the U.S. It offers so many investment options that even the pickiest user will find the best one suitable for them. With Robinhood, one can not only invest in stocks, ETFs and options but also indirectly buy and sell certain cryptocurrencies.

Robinhood can be called a kind of modern hybrid application that combines traditional investment practices with a brand-new approach to democratized investing. It is a perfect solution combining incredible functionality and an extremely user-friendly design.

Robinhood owners also selected a perfect monetization strategy with the subtle payment for order flow-centered revenue structure and offer their users a “Gold” version of the application for a $5 monthly fee. With it, users can access research reports, instantaneously gain access to lots more financial capital than they possess through [borrowing] margin funds, and get quicker access to more funds that they deposit from linked financial institutions.

Acorns

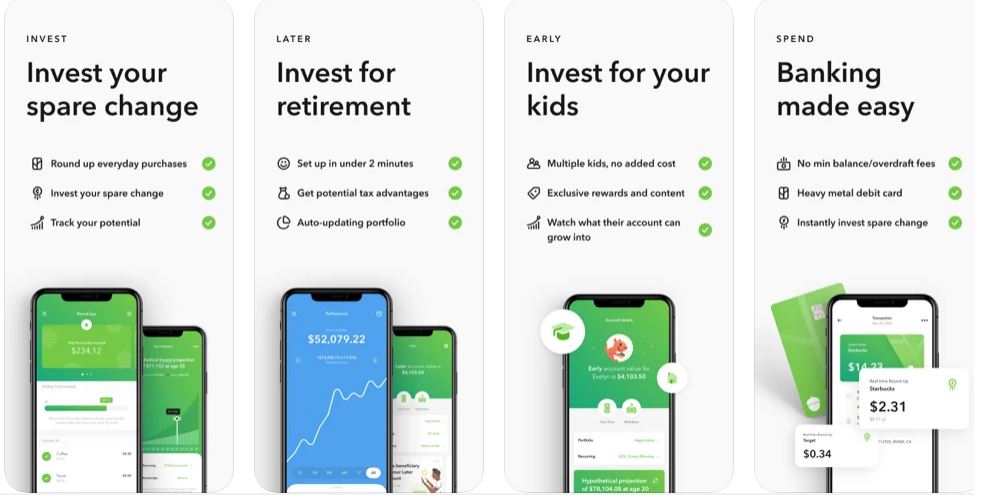

Image source: Acorns

As you can see from the screenshot above, Acorns offers an investment diversity that users could only dream of before it became a reality. No wonder since the motto of this solution is “Acorns help you grow”. It is an easy, smart and secure solution that you can use for different investment purposes.

Apart from having a great solution, Acorns creators also offer their custom investment tips, useful content and over 55,000 fee-free ATMs. There are also automated investment accounts for novice users and bonus investments.

Acorns is a living proof of what works the best – a variety of options, an easy-to-understand interface and pro tips. What else can users want from an investment app of this kind?

To wrap it up

We observe a boom in new solutions that make financial operations more accessible and easy. One such notable type of solution is the investment app.

This popularity has grown over the years, and their development can be called a great business venture. All you need to do is identify your target audience and their investment preferences and then build an investment solution able to meet those preferences.

Banking apps, cryptocurrency investment apps and exchange trading solutions are what most investors prefer. So choose your type of investment app, equip it with various options, strengthen its security, and spice it up with something unique, useful and aesthetic- and you are good to go.

FAQ

Stock trading platforms imply a short-term approach. So you just buy and sell stocks without focusing on long-term, fundamental aspects of businesses or the economy.

As to the investment platforms, they encourage their users to focus on strategies that imply a more long-term outlook, emphasising slow and steady gains over a certain sizable time horizon.

If you would like to target a wide-ranging audience and form a broad customer base, we would recommend you go for both options. Millennials and Gen Zers prefer investing using mobile solutions, while the more conservative older generations, Generation X and Baby Boomers, still, for the most part, feel more comfortable using desktop computers for such matters.

One Response

Very very Good