Table of Contents

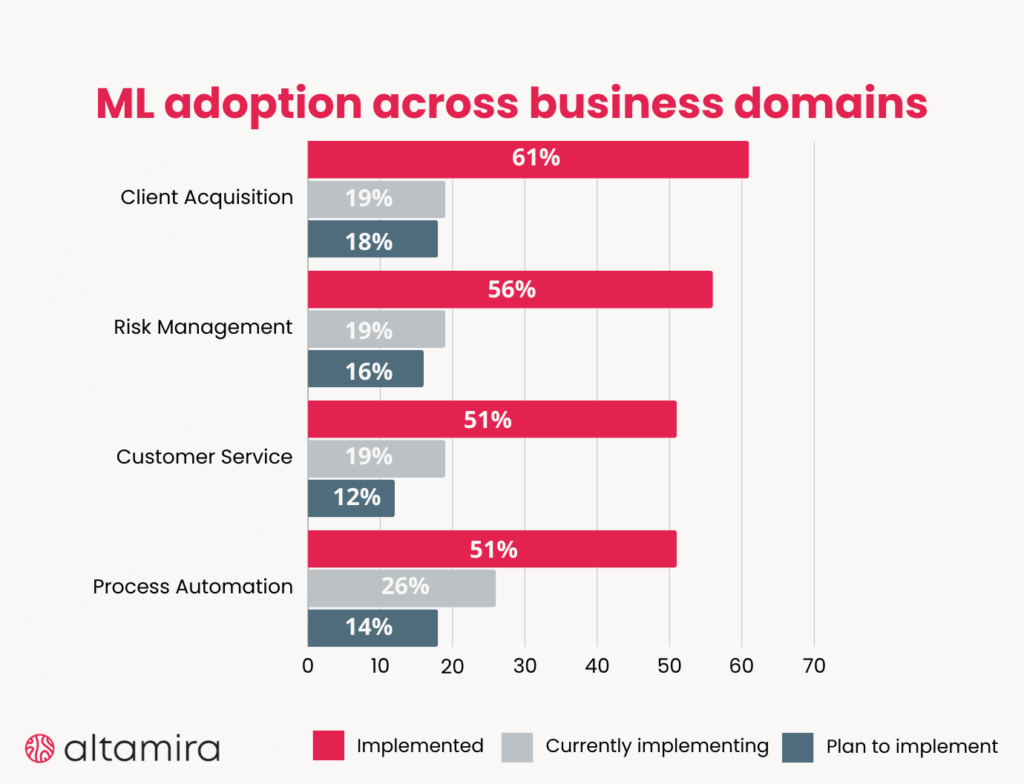

The ongoing shift towards digital platforms allows banks to serve a larger audience, expand their market presence, and increase their revenue while cutting costs. Banks that capitalise on this opportunity also have access to vast data sets vital for improving analytics and machine learning algorithms for better decision-making.

When implemented at scale, decision-making tools driven by artificial intelligence (AI) can provide a bank or other financial institution with a highly competitive advantage, creating additional value for customers, partners, and the bank itself.

Financial experts obtain a deep insight into the finance sector, allowing banks to utilise the data for providing informed advice on loans, insurance, and wealth management, thus boosting customer happiness. The use of AI for instant data access and analysis enables financial companies globally to anticipate financial trends proactively. As a result, financial services can deliver customised offers that match individual financial goals.

So, it is a wise decision to develop a holistic AI and analytics framework for those banks looking to stand out in global and regional markets increasingly shaped by digital ecosystems. This strategy should incorporate four key components: a reinvented customer engagement approach, AI-powered decision-making processes, a solid core of technology and data infrastructure, and a cutting-edge operational model.

ML-based fintech solutions in finance industry: types and value

Now, let’s explore the various applications of machine learning (ML) in fintech that exist as technologies and how they can benefit your business. This will give you an overview of the potential solutions you might consider integrating into your operational workflows.

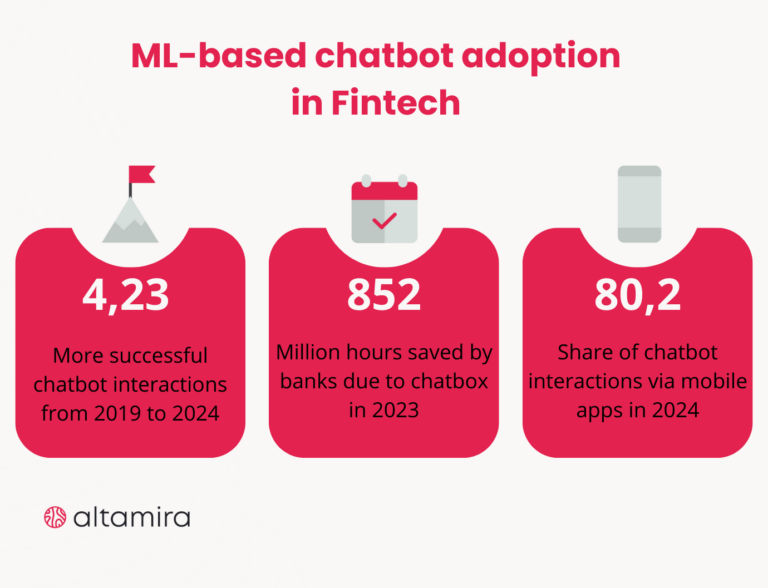

Customer service and support

Enables round-the-clock assistance for queries and account management, offering basic financial advice to improve accessibility and reduce wait times.

How to implement: Use chatbots and virtual assistants.

Predictive lead scoring

Assesses the likelihood of prospective customers making a purchase based on their behaviour and historical data, optimising marketing efforts towards more promising leads.

How to implement: Use predictive analytics frameworks that evaluate customer engagement and conversion history.

Automated risk management

Uses machine learning to quickly identify and mitigate risks, analysing market trends, customer behaviours, and transactions.

How to implement: Use machine learning models trained on specific data to spot risk patterns.

Fraud detection and prevention

Machine learning algorithms help to sift through transaction data for unusual patterns, suggesting fraudulent behaviors, thus facilitating swift preventive measures.

How to implement: Apply anomaly detection and predictive modelling to scrutinise transactions for irregularities.

Personalised fintech product usage experience

Customise financial offerings and services for each customer by analysing their behaviour and financial background, thereby boosting their satisfaction and engagement levels.

How to implement: Use recommendation systems and personalisation algorithms that process customer data to deliver tailored financial guidance, products, and services.

Insurance claim processing

Streamlines the claim process by automating data entry, document verification, and preliminary assessments for greater efficiency and accuracy.

How to implement: Employ NLP for document analysis, computer vision for damage assessment, and predictive models for initial claims evaluation.

Data management and document processing

Automates data extraction and analysis from large volumes of data sets to reduce manual work and improve data accuracy.

How to implement: Use NLP for the extraction of large data sets and machine learning for data classification and analysis.

While adopting all these applications might seem appealing, businesses often focus on a few ML solutions, centring their digital strategy around them. Therefore, it’s highly recommended to prioritise one ML solution and initially dedicate efforts towards its development and integration.

What benefits can you get by using machine learning in fintech?

Customer retention and acquisition based on data analysis

Banks create targeted advertisements or proposals and gain insights into a customer’s intentions by examining a unique user behavior. They seize the opportunity to attract new clients who are in need of customised offers at the moment and can also take steps to retain services if there’s an indication that the client is considering discontinuing their relationship with the bank.

Minimised security threats

Machine learning-driven solutions for fraud detection, anomaly identification, and transaction monitoring can pinpoint unusual activities, thereby resulting in improved security safeguarding both fintech companies and their customers from potential risks.

Full regulatory compliance

Machine learning helps financial companies adhere to data protection regulations such as HIPAA and GDPR by leveraging automated tools for compliance monitoring and reporting. Such support not only helps in building customer loyalty and trust but also in avoiding non-compliance fines, which can reach up to 4% of annual revenue.

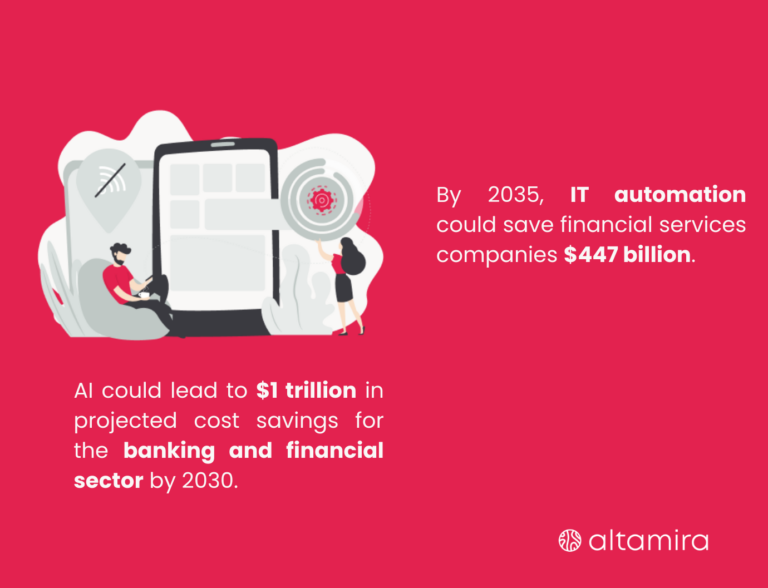

Cost reduction

Machine learning-powered process automation in the financial services industry diminishes the need for manual input to a considerable degree, leading to notable cost reductions and a streamlined organisational structure for the business. Given that staff expenses account for an average of 27.8% of all operational costs in fintech, the potential savings from optimising in this area are substantial.

Better risk management

Machine learning-based predictive models and risk assessment tools facilitate the management of financial risks. This capability results in the development of more effective risk mitigation strategies and improves the prediction of risk factors.

How can banks apply MLOps: Common challenges and real-world cases

The application of Machine Learning Operations (MLOps) spans over diverse initiatives covering artificial intelligence within the banking industry. These practices facilitate the efficient development, deployment, and maintenance of AI models, ensuring they deliver their intended outcomes reliably and at scale.

Fraud detection

Fraud represents a continuous and significant challenge for financial institutions, with the imperative of detecting fraudulent activities swiftly to reduce losses and safeguard customers. Banks and financial institutions are actively developing and implementing fraud detection models capable of automatically analysing vast amounts of data, recognizing patterns, and identifying potential fraudulent activities in real-time. These models scrutinise transactional data, customer details, and other pertinent information to pinpoint potential fraud.

The development and deployment of fraud detection models involve a series of critical steps, including data preparation, model development, model deployment, and model monitoring. MLOps ensure these steps are executed efficiently:

- MLOps practices enable data science teams in banks to automate the collection, cleaning, and preparation of data for use in the models, streamlining the initial stages of model development.

- Through MLOps, data scientists can develop models in a consistent and reproducible way, adhering to best practices in data analysis, feature selection, and model training, ensuring the integrity and quality of the model development process.

- As AI/ML models transition into the production environment, MLOps facilitates the deployment in a scalable and reliable manner. This includes leveraging best practices for containerisation, orchestration, and monitoring, ensuring the models operate smoothly in real-world applications.

Real-world case: Ayasdi

This company provides both cloud-based and on-site machine intelligence solutions to assist organisations in addressing complex challenges. Ayasdi is used for identifying, assessing, and managing risks, forecasting customer demand, and helping in the reduction of money laundering activities. Leveraging Ayasdi’s anti-money laundering solutions, a bank can reach up to 20% savings on investigation costs.

Personalisation and customer segmentation

Despite substantial investments in AI, banks have struggled to effectively extract predictive insights from their ML models for managing customer personalisation programs and guiding their marketing campaigns. Challenges such as inconsistent customer data, the limited scope of ML models, one-off use cases, models that are difficult to replicate, and restricted knowledge sharing represent significant obstacles to achieving successful personalisation at scale.

Currently, many models are trained on specific, isolated instances with short-term, product-focused goals like increasing mortgage applications or new account openings. This approach overlooks the importance of identifying factors that drive customer lifetime value and using those insights to tailor customer interactions. MLOps can play a decisive role in preserving best practices in data analysis, feature selection, and model training, thereby enhancing the effectiveness of personalisation strategies.

By adopting MLOps practices, banks can construct an integrated technology stack that orchestrates an insights loop. This loop connects enterprise data with ML models and channels the insights generated back into campaign strategies, ensuring a consistent and informed approach to customer engagement.

Real-world case: Kensho

This company provides Machine Learning and Data Analytics services to top financial institutions, including Bank of America, Morgan Stanley, S&P Global, and J.P. Morgan. Kensho’s analytical solutions leverage the forefront of NLP and Cloud Computing technologies, enabling us to make data-driven decisions with conviction.

Credit risk assessment

Credit risk poses a significant challenge for banks, owing to the numerous factors that constitute an individual’s risk profile. Assessing credit risk involves scrutinising a borrower’s credit history, financial statements, and other pertinent data to gauge their capability to repay a loan. This task becomes even more complex for business borrowers, requiring the aggregation and analysis of data across various parameters and timeframes to form a comprehensive risk assessment.

ML models are continuously supplied with data, tasked with extracting insights, and subsequently used to generate predictive insights on new data sets. This iterative process improves the accuracy of ML models with each training cycle.

However, ML models may incorporate assumptions that present significant challenges when analysing volatile historical financial data, potentially resulting in suboptimal model performance. Additionally, there’s a heightened risk of overfitting, as ML models tend to be more sensitive to anomalies than traditional analytical methods.

While ML models can be prone to overfitting and may struggle with noisy financial data, these risks can be mitigated. Regular validation against new data sets, careful feature selection, and ensemble techniques ensure models remain reliable and accurate.

Real-world case: ZestFinance

Los Angeles-based ZestFinance has launched the Zest Automated Machine Learning (ZAML) platform, an innovative underwriting solution that enhances credit assessment processes. The platform stands out for its use of diverse data points, offering an unprecedented level of transparency in the lending process.

As a result, lenders are now better equipped to evaluate individuals previously deemed too risky for loans. Designed for rapid implementation and scalability, ZAML platform is tailored to meet the needs of the modern lending environment. According to recent research, auto lenders that have adopted ZAML have reported a 25% reduction in their annual losses, showcasing the platform’s significant impact on minimising financial risk.

Wrapping up

The financial services sector is proactively adopting AI to deliver superior and outstanding customer service. AI-driven solutions are the driving force in attaining growth goals. A majority of CFOs and finance leaders see AI as a catalyst and are confident in realising a positive return on AI investments. Now is the opportune moment to venture into developing transformative AI solutions to unlock remarkable growth.

How we can help you?

At Altamira, we use artificial intelligence and machine learning to automate your business processes and supercharge your fintech projects. With deep expertise in both the technological and financial domains, we’re here to drive your fintech solutions to new heights.

We specialise in

AI/ML software consulting and development: We offer expert consulting services in artificial intelligence and machine learning, tailored specifically for the fintech industry. Our goal is to improve your decision analytics capabilities, enabling smarter, data-driven decisions that drive your finance initiatives forward.

Vendor audit and vendor transfer: Our team conducts comprehensive technical process audits to identify areas for improvement in your software development lifecycle, ensuring increased efficiency and velocity, particularly in AI-driven projects.

Mobile and Web fintech product development: From ideation to launch, we specialise in developing mobile and web applications that integrate advanced AI and ML functionalities, providing end-to-end delivery that meets your unique business requirements.

Efficient Team Augmentation for AI Projects: Whether you need in-house, outsourced, or distributed team augmentation, we provide fast and efficient solutions to scale your AI and ML development efforts, aligning with your organisational goals and timelines.

Contact us take your financial services to the next level of efficiency. Let us help you turn data into actionable insights and strategic decisions, driving growth and success in the digital finance landscape.