Stockino

Financial software for asset, portfolio, and financial market management professionals

Registration software for securities traders

Stockino is financial software for comprehensive management and automation of investment portfolio management processes used mainly by professionals from brokerage companies (securities trader). It serves as an automation and registration software meeting the criteria of the regulator – the National Bank of Slovakia. STOCKINO is a modular, configurable and customizable system to reflect any requirements of financial companies.

Features

Stockino is a platform operating in a web browser environment, whether in the cloud or on-premise – within the operator’s internal network. It contains a comprehensive and modular set of functionalities for the management of all processes of companies in the field of wealth management.

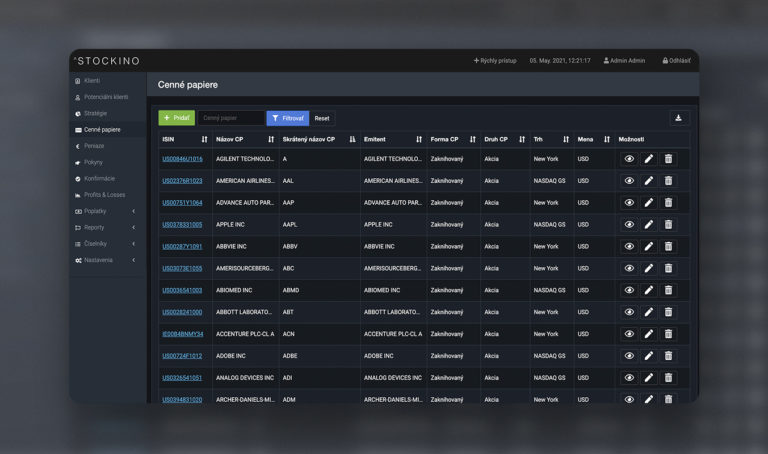

- Management of investment products - securities, bonds

- Records of clients, contracts, cash, and property accounts

- Fractional trading

- P&L - calculation of portfolio performance

- Online data from financial markets

- Management of the fee structure

- Reporting

- Creation and management of investment strategies

- Open REST API

- Online onboarding and client frontend

Altamira is trusted by

How does Stockino work?

What modules does Stockino include?

Of course, the supporting element and unifying entity of the entire system is the Client and the Securities, respectively. Equita, with which almost all other modules of the entire system are linked. We record all legally required information about clients within the system, as well as other necessary data and entities, which subsequently enable the management of the necessary processes.

Investment strategies or portfolios

Investment strategies are one of the core modules of Stockino. They serve to categorize clients and at the same time automate the collective management of the investment portfolio. An investment strategy is a fully configurable entity, containing selected assets and a benchmark (e.g. S&P 500), according to which the performance of the strategy is compared. In the case of an active module for automatic calculation of trades, Stockino will also take care of automating the creation of purchase orders for such a number of assets that corresponds to the percentage ratios within the given strategy and at the same time takes into account the status of the client’s financial accounts. This also implies the need to work with fractional shares, and Stockino is adapted to the possibility of fractional trading.

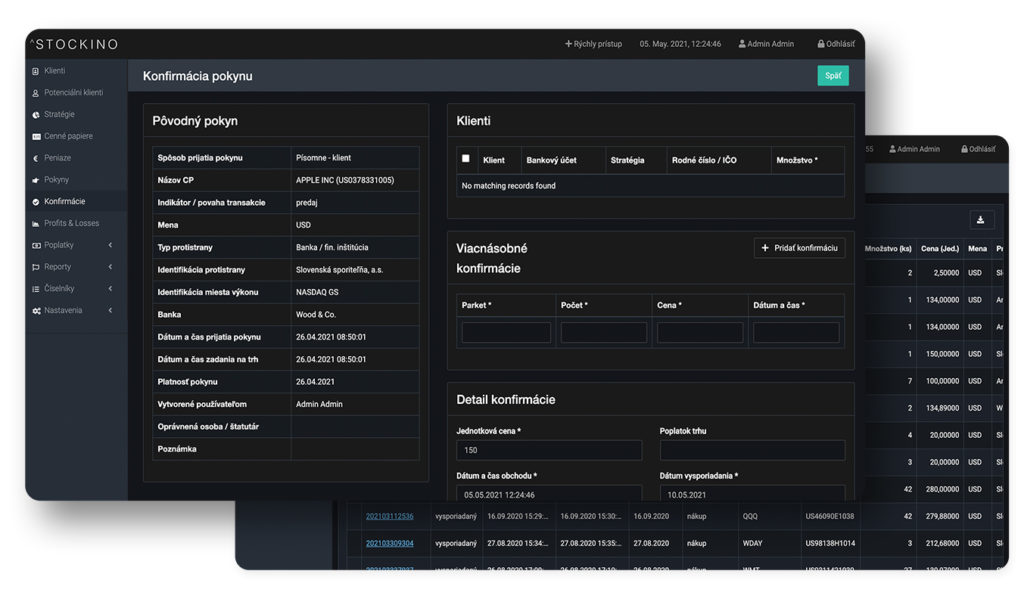

Money, instructions, confirmations

Money, instructions and confirmations are important and interconnected modules for depositing, subsequent confirmation and entering market orders. In OCP companies, as a rule, responsibilities are divided between Front Office and Back Office. This also reflects the setting of user roles and powers within Stockino.

Entering orders to buy or sell into the system is on the agenda of the user with the role of Front office, and the actual confirmation and processing of orders is usually the responsibility of another administrator – this way the multi-touch control is preserved.

The entry of the order itself, its validation, confirmation, entry to the market and settlement are very complex screens, which are linked to a large number of validations and automatic checks. The goal of automated validation is to prevent possible errors and at the same time to generate such high-quality data in the system that subsequent reporting to the regulatory authorities takes place without problems.

The mentioned modules also include settlement of dividends, possible stock-splits, as well as management and accounting of the fee structure. The fee structure is fully configurable and adjustable according to the needs of a specific customer.

Reporting

Stockino contains a very complex reporting module, within which it is possible to look at the data of the entire company from different perspectives. In addition to legally required reports e.g. reporting for the National Bank of Slovakia or ESMA reporting, dozens of other internal reports are available. These serve clients (e.g. evaluation of funds, statements from accounts) and internal needs (e.g. overviews of deposits, transactions, instructions).

Many of the reports are automated and the outputs are sent at set intervals to where they are expected – to the client or system administrator.

Stockino also contains a number of internal “triggers” that generate a report or at least a notification, it also includes the so-called AML – Anti Money Laundering report. At the same time, reports are one of those functionalities that are often programmed for a specific customer, as they can come up with their own view of the data that the company collects.

Reports by the regulators NBS and ESMA are generated automatically, while the entire system is designed so that the data collected and recorded in Stockino are comprehensive enough for the generation of the given reports by legislation.

Profit & Losses

P&L is a separate Stockino plugin, a very complex module for monitoring the performance of individual portfolios, or entire investment strategies. It contains a complex mathematical model for calculating the value of the portfolio.

Our products

Ensure fast and secure data transfer within the ecosystem.

SlimEDC

Strive for excellence with Altamira

Altamira has been awarded numerous times in recognition of its performance and achievements. Join our community of successful customers, whom we helped to build and grow their businesses.

Discover why customers choose Altamira

CTO, SOLJETS

Ryan Crawford

Custom-made ERP solution that provides jet brokerage services to boost jet sales and service quality.

Services we provided

- Web Application

- UI/UX Design

CEO & Co-founder, Aquiline Drones

Barry Alexander

Android and iOS native applications that provide on-demand drone services, where users can connect with couriers and track the status of their drone order delivery.

Services we provided

- Mobile Application Development

- UX/UI Design

CTO, Ticker Tocker

Jonathan Kopnic

Web, iOS, and Android trading platform that offers advanced capabilities in earning by trading, selling products via the integrated marketplace, and conducting trading live-streaming.

Services we provided

- Discovery

- Tech Vendor Audit

- Web and Mobile Application Development

IT Solution Team Leader

Dusan Barus

Unique mobile solution that automates the process of uploading, transferring, documenting, numbering, and downloading pictures.

Services we provided

- Web Application Development

- UX/UI Design

CEO, CTRL Golf

Ian Cash

Unique mobile application that aims to teach users to play golf according to individual playing styles and recommendations provided by specifically developed algorithms.

Services we provided

- Discovery

- Mobile Application Development

- UX/UI Design

Head of Services, Universal Edition

Electronic document delivery ecosystem development for music publishing.

Services we provided

- Web application development

- Software Development

Looking forward to your message!

- Our experts will get back to you within 24h for free consultation.

- All information provided is kept confidential and under NDA.